Financial News Highlights

- February’s Consumer Price Index report showed that inflation came in higher-than-expected for a second consecutive month – a development which is likely to be on the Fed’s agenda at their two-day meeting next week in financial news.

- Spending in the retail sector disappointed expectations, despite some recovery from last month’s notable decline.

- With inflation top of mind, U.S. small businesses were also feeling less optimistic in February.

Sticky Prices Could Delay Rate Cuts

The key data among this week’s releases was the consumer price inflation numbers in financial news. While the headline monthly figure was in line with expectations, the details could give the Fed more to discuss in their upcoming policy meeting next week. Markets took the report in stride, with Treasury yields up a bit and the major stock indices closing the day higher after the release.

Delving into the details, the CPI report showed that both monthly and annual headline inflation accelerated in February, largely reflecting a rise in gasoline and shelter prices. This was also accompanied by higher-than-expected figures for both monthly and annual core inflation. Notably, the prices for core goods unexpectedly ticked higher in February after eight consecutive months of price declines. Back-to-back months of stronger than expected readings on core inflation point to an uneven road ahead as the Fed attempts to steer inflation back to target.

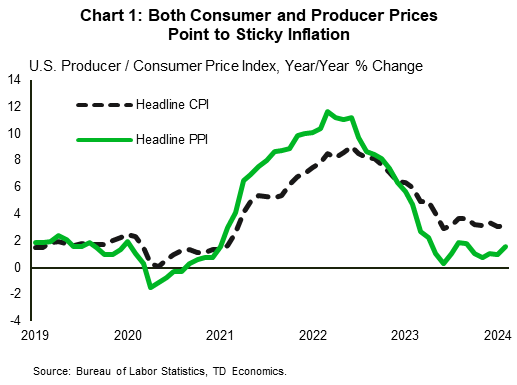

Price pressures further up the supply chain were also a little hotter than expected in February. The Producer Price Index (PPI) also came in above expectations. Both the monthly and annual headline PPI numbers accelerated relative to January. As such, both the consumer and producer price reports suggest that inflationary pressures remain sticky (Chart 1).

Adding to the subjects that the Fed will likely be mulling over during their meeting, is the 0.6% m/m gain in February’s retail sales after a sizeable pullback in January. On the upside, while retail sales growth flipped back to positive territory, it was lower than market expectations (0.8%). What’s more, the control group category, which factors into the calculation of personal consumption expenditure, was flat on the month relative to expectations for growth. Overall, the data suggests that consumers still have the ability to spend, despite challenges to their balance sheet, such as higher prices.

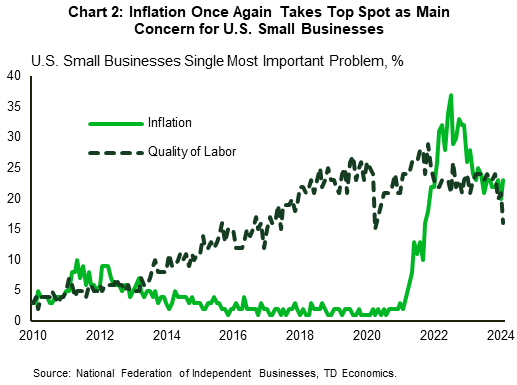

Inflation was also high on the list of concerns for America’s small businesses. A net 23% of respondents to the NFIB’s small business survey noted that inflation was their single most important business problem, up three points from the previous reading (Chart 2). Overall, small businesses were less optimistic in February, with the optimism index dropping to a nine-month low of 89.4. This was lower than market expectations for a slight improvement and notably below the series’ 50-year average of 98. On the upside, small businesses are having an easier time attracting and retaining employees, such that the net percentage of firms who increased compensation or are planning to do so in the near-term both fell over the month.

The key takeaway from this week’s releases is that while the labor market is normalizing as indicated by responses from the small business sector, consumers still have spending power and inflationary pressures have not fully abated. The combination suggests that the Fed is likely to remain cautious with respect to rate cuts, erring on the side of leaving rates higher for longer rather than take the risk of re-igniting price pressures by cutting prematurely.

Shernette McLeod, Economist | 416-415-0413

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.