Financial News for the Week of May 10th, 2024

Financial News Highlights

- The Federal Reserve Senior Loan Officer Opinion Survey showed that most banks tightened lending standards further in the first quarter, with demand for loans falling in concert in financial news.

- Growth in U.S. consumer credit slowed materially in March as the upward trend in rates through the first quarter weighed on volumes.

- Federal Reserve officials reiterated their expectations that interest rates would need to remain higher for longer to ensure inflation returns sustainably to their 2% target.

Credit Conditions Tighten as Fed Remains Vigilant

After last week’s Federal Reserve decision and employment report, the second week of May was comparatively lighter on data releases. First quarter reports for lending activity and consumer credit showed that tighter lending standards continue to weigh on credit demand. However, financial markets were more attentive to the comments of Federal Reserve officials as they sought insights on the potential path of monetary policy moving forward. As of the time of writing, the S&P 500 was up 2.1% on the week, while Treasury yields were roughly unchanged.

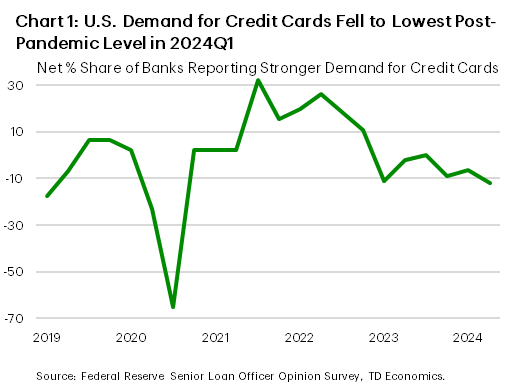

Starting things off on Monday, we received the updated Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) for the first quarter. Survey responses showed that banks continued to tighten lending standards and report weaker demand for loans across all business and consumer loan categories. Relative to the fourth quarter of 2023, more banks tightened lending standards for consumer credit, fewer tightened commercial and residential real estate credit, and roughly the same number of banks tightened commercial & industrial credit in financial news. Within consumer credit, tighter lending standards pushed the net share of banks reporting stronger demand for credit cards to its lowest level since mid-2020 (Chart 1).

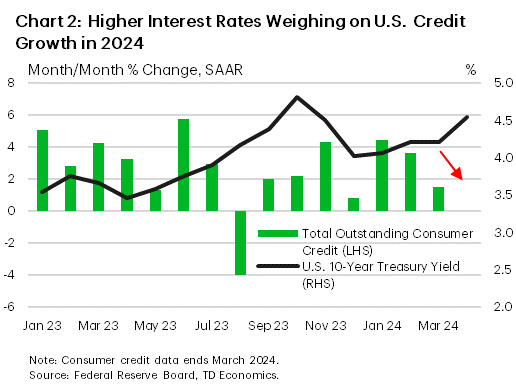

Looking at the monthly breakdown for consumer credit, the March data showed consumer credit growth decelerated considerably through the first quarter as interest rates trended higher (Chart 2). While consumer credit still expanded 3.2% (annualized) in the first quarter, the gains were largely front-loaded in the earlier months and tapered off as financial conditions tightened. With interest rates continuing to push higher through the first half of the second quarter, it seems likely that a further softening in consumer credit growth will occur over the coming months. Combined with depleted pandemic excess savings, weakening consumer credit growth is expected to lead to moderating consumption growth in 2024. While this should aid the Federal Reserve in their attempts to return inflation to their 2% target, officials emphasized their vigilance in recent remarks.

Vice Chair and New York Fed President John Williams noted this week that monetary “policy is in a very good place, and we have the time to collect more [data], so steady as she goes”. This sentiment was echoed by Richmond Fed President Barkin who stated his optimism that “today’s restrictive level of rates can take the edge off demand in order to bring inflation back to our target”. Most members noted that they did not expect further policy tightening to be necessary, with Minneapolis Fed President Kashkari stating that “the bar for us raising is quite high, but it’s not infinite”. While the prospect for higher rates is unlikely at this time, Fed officials are expected to remain vigilant against the potential for upside risks to inflation.

April’s Consumer Price Index report next week will offer the next barometer on inflation trends as the Fed prepares to update their Summary of Economic Projections ahead of their next meeting on June 11-12th.

Andrew Foran, Economist | 416-350-8927

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of May 3rd, 2024

Financial News Highlights

- The Federal Reserve held the policy rate steady this week and signaled that rates will likely remain higher for longer in financial news.

- The U.S. jobs engine slowed in April, adding 175k jobs. The unemployment rate rose modestly to a still low 3.9%.

- Last year’s productivity surge has come to an end. Productivity growth slowed to a stall speed in Q1, while unit labor costs turned sharply higher.

Holding Steady for Longer

It was a very busy week on the economic data calendar, but the two headliners were a pulse check on the state of the labor market and the Federal Reserve’s interest rate announcement in financial news. Policymakers delivered no surprises this week, with the FOMC voting unanimously to hold the policy rate steady at the current target range of 5.25% - 5.5%. The same can’t be said for April’s employment report, which showed job growth coming in handily below expectations. Financial markets greeted the news positively, with the S&P 500 recouping its losses from earlier in the week, while the 10-year Treasury yield was down 14-bps to 4.53% at the time of writing.

It’s not that long ago that investors were expecting the first rate cut to come at this very meeting. But after three months of hotter-than-expected inflation readings, the FOMC appears to be on hold indefinitely, as it looks for “greater confidence that inflation is moving sustainability back towards 2%”. What exactly that means remains to be seen, but it will likely require a further rebalancing in the labor market, which ultimately leads to more sustained downward pressure on wage growth.

From that perspective, April’s jobs data was a Goldilocks report. Non-farm payrolls rose by 175k while the unemployment rate ticked up to 3.9%. Importantly, average hourly earnings cooled more than expected, with the 12-month change slipping to a near three-year low of 3.9% (Chart 1).

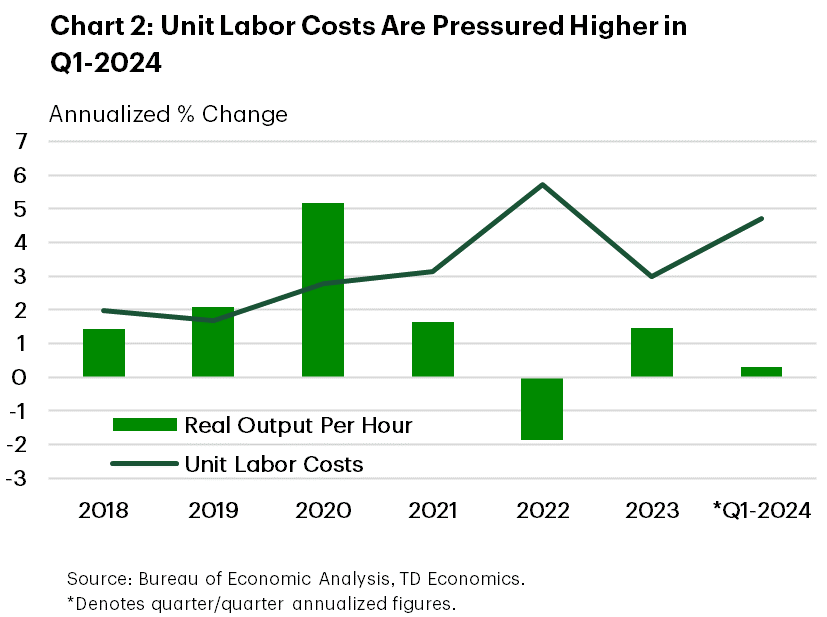

While the softening in wage growth will come as welcome news for Fed officials, it needs to be weighed against other measures of employee compensation, particularly the Employment Cost Index – the Fed’s preferred wage measure – which showed an unexpected acceleration. Moreover, after rising by a robust 1.5% in 2023, growth in non-farm productivity slipped to a near stall speed in Q1. Taken alongside last quarter’s uptick hourly compensation, unit labor costs (ULC) also rose sharply higher (Chart 2). This has important implications for inflation. ULC can best be thought of as a productivity adjusted cost of labor, making it a useful gauge on the extent to which the nominal pace of compensation growth is running above (or below) what would be consistent with achieving 2% inflation. However, with the Q1 reading not only turning higher but also running at an annualized rate that’s more than double where it should otherwise settle, provides yet another signal that progress on the inflation front has indeed stalled.

In the press conference following the release of the FOMC statement, Chair Powell noted that while ongoing progress is “not assured” he still expects that over the course of the year “inflation will move back down”. But Powell also emphasized that he’s become less confident in that forecast. Moreover, when asked if today’s rates were “sufficiently restrictive” Powell instead described them as only “restrictive”. While the Chair said further rate hikes are “unlikely”, the refusal to characterize today’s stance as sufficiently restrictive is an implicit acknowledgment that further policy firming cannot be ruled out. At this point, we view this as highly unlikely. But given the economy’s sustained strength alongside the recent stalling on inflation, we now expect the Fed to remain on hold until December.

Thomas Feltmate, Director & Senior Economist | 416-944-5730

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of April 19th, 2024

Financial News Highlights

- U.S. headline retail sales beat expectations in March, advancing for a second consecutive month in financial news. The strong showing bolstered the case for a delayed start to the Fed’s interest rate cutting cycle.

- Comments from senior Federal Reserve officials has the timing of possible interest rate cuts in question amid signs of persistent strength in the U.S. economy and higher-than-anticipated inflation.

- In contrast, the housing market continues to feel the weight of higher interest rates as housing starts and home sales dipped in March.

Dialing Back Expectations

This week featured releases on retail sales and the housing market in March in financial news. Also high on the market’s radar were comments made by the Federal Reserve Chair, which suggested the central bank may be changing its tune on the path and timing of interest rate cuts. Overall, markets responded strongly to the new information with stocks heading lower and treasury yields rising (10 year yields were up 9 basis points at time of writing) as investors recalibrated their expectations for rate cuts this year.

This week featured releases on retail sales and the housing market in March in financial news. Also high on the market’s radar were comments made by the Federal Reserve Chair, which suggested the central bank may be changing its tune on the path and timing of interest rate cuts. Overall, markets responded strongly to the new information with stocks heading lower and treasury yields rising (10 year yields were up 9 basis points at time of writing) as investors recalibrated their expectations for rate cuts this year.

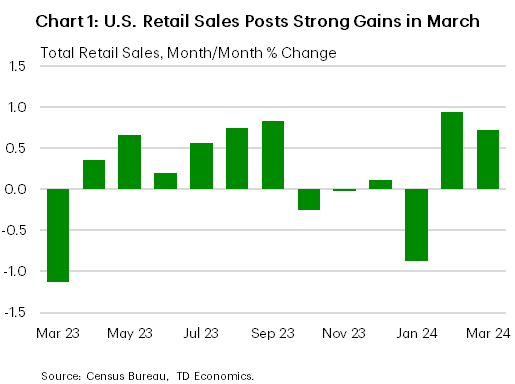

A stronger-than-expected gain in retail sales in March reinforced that the U.S. economy is still strong, and is expected to lead growth among developed countries this year, according to recent IMF projections. Headline retail sales rose for a second consecutive month in March, after a string of monthly declines, with sales in the key control group acting as a driver (Chart 1). Given the soft start to the year, March’s increase just managed to lift the quarter into positive territory (up 0.2% q/q annualized). The notable uptick also represents an upside risk to our own forecast for 2024 Q1 consumer spending, and doesn’t help the Fed in its goal of taming price growth.

On Tuesday, the Federal Reserve Chairman and the Vice Chair at two separate events both signaled that the central bank may be changing its tune. While policymakers started the year anticipating that they would commence the rate cutting cycle soon, hotter-than-expected inflation has shifted that calculus. In a prepared remark, Vice Chair Jefferson noted that interest rates could remain at their current restrictive level for longer if inflation persisted. Later, Fed Chair Powell echoed that sentiment. He noted that excluding a sudden economic slowdown, interest rates would need to stay restrictive for longer. The Fed Chair’s new tone is essentially one of dialing back expectations as markets had aggressively priced in numerous cuts this year. Investors on average are now expecting one and two cuts.

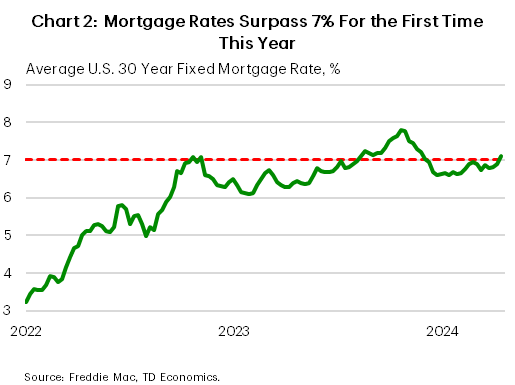

Higher rates are having a measurable effect on the housing market as data on existing home sales and housing starts and permits all declined in March. Both housing starts and building permits retrenched in March. In another release, existing home sales fell 4.3% m/m in March – the largest decline in over a year. While the measure managed to post a gain for the first quarter as a whole, relative to the subdued levels in 2023 Q4, the prospect of higher for longer interest rates are likely to see these gains pared back in the future. In fact, this week, the average rate on a 30-year fixed rate mortgage climbed above 7% for the first time this year and is likely to weigh on housing activity going forward (Chart 2).

Higher rates are having a measurable effect on the housing market as data on existing home sales and housing starts and permits all declined in March. Both housing starts and building permits retrenched in March. In another release, existing home sales fell 4.3% m/m in March – the largest decline in over a year. While the measure managed to post a gain for the first quarter as a whole, relative to the subdued levels in 2023 Q4, the prospect of higher for longer interest rates are likely to see these gains pared back in the future. In fact, this week, the average rate on a 30-year fixed rate mortgage climbed above 7% for the first time this year and is likely to weigh on housing activity going forward (Chart 2).

Given recent readings on inflation and retail spending, and FOMC members comments acknowledging that rates will likely need to remain restrictive for longer, next week’s consumer spending and income data for March are highly anticipated. In particular, the Fed’s preferred inflation metric – the core PCE deflator – will be very closely watched to see how much of the recent hot CPI inflation carries over to PCE.

Shernette McLeod, Economist | 416-415-0413

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of April 12th, 2024

Financial News Highlights

- Inflation, as measured by the Consumer Price Index, accelerated to 3.5% year-on-year in March – the highest reading in six months in financial news.

- Minutes from the Federal Reserve meeting in March showed that officials remained in favor of exercising patience amid persistent inflationary pressures.

- U.S. Treasury yields spiked roughly 15 basis-points as market expectations for lower interest rates were pushed back into the second half of the year.

One Hundred Days into 2024, Rate Cuts Remain on the Horizon

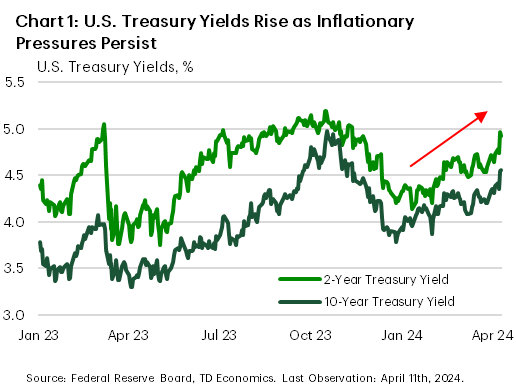

Financial markets were caught off-guard this week in financial news as slightly hotter than expected inflation data prompted a spike in U.S. Treasury yields and a modest retreat in equity prices. As of the time of writing, the ten- and two-year Treasury yields finished the week up roughly 15 basis-points (Chart 1), while the S&P 500 fell 0.9%. While the deviation relative to expectations for the March Consumer Price Index (CPI) inflation was marginal, the underlying details proved to be more concerning.

Financial markets were caught off-guard this week in financial news as slightly hotter than expected inflation data prompted a spike in U.S. Treasury yields and a modest retreat in equity prices. As of the time of writing, the ten- and two-year Treasury yields finished the week up roughly 15 basis-points (Chart 1), while the S&P 500 fell 0.9%. While the deviation relative to expectations for the March Consumer Price Index (CPI) inflation was marginal, the underlying details proved to be more concerning.

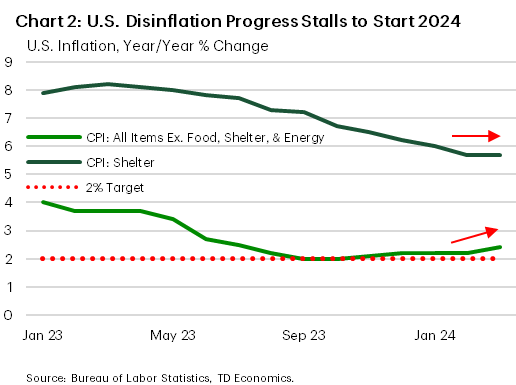

Headline inflation in March jumped to 3.5% year-on-year, with energy prices seeing positive price growth in annual terms for the first time in over a year. Excluding energy and food prices, core inflation remained unchanged relative to February at 3.8%. The reason why the disinflation process stalled in the first quarter is related to two factors. The first is that disinflation in the heavily weighted shelter subcategory moderated relative to the previous quarter. While this offered less support to the Fed’s mission to reattain price stability, the measurement of shelter prices is lagged relative to market trends by several months, and thus the direction of shelter inflation is still expected to be downward moving forward.

The second factor keeping inflation elevated was the acceleration in price growth for categories excluding food, energy, and shelter – aggregately referred to as super core inflation. Inflation pressures within this subcategory were broad-based in the first quarter (Chart 2) which has not gone unnoticed by the Federal Reserve. In the March meeting minutes released this week, FOMC participants noted they were reluctant to discount the inflation data of the first quarter and emphasized that they would require greater confidence that inflation was on a sustainable trajectory back to the 2% target before considering less restrictive policy options.

This lined up with the even-toned statements made by Federal Reserve officials this week, including Vice Chair and New York Fed President John Williams who stated that he expects “inflation to continue its gradual return to 2 percent, although there will likely be bumps along the way, as we’ve seen in some recent inflation readings”. In a speech this week, Boston Fed President Susan Collins also stated “Overall, the recent data have not materially changed my outlook, but they do highlight uncertainties related to timing, and the need for patience”. Market pricing for the first Federal Reserve cut this year shifted from June to July this week, although market confidence remains weak with the balance of risks skewed towards the potential for a later commencement date.

This lined up with the even-toned statements made by Federal Reserve officials this week, including Vice Chair and New York Fed President John Williams who stated that he expects “inflation to continue its gradual return to 2 percent, although there will likely be bumps along the way, as we’ve seen in some recent inflation readings”. In a speech this week, Boston Fed President Susan Collins also stated “Overall, the recent data have not materially changed my outlook, but they do highlight uncertainties related to timing, and the need for patience”. Market pricing for the first Federal Reserve cut this year shifted from June to July this week, although market confidence remains weak with the balance of risks skewed towards the potential for a later commencement date.

Looking to next week, we receive an update on retail sales for March on Monday, which are expected to show slower growth relative to the prior month, in part owing to a moderation in auto sales. Next week also marks the start of the Spring IMF meetings, which will include meetings between the Fed and the U.S. Treasury and their international counterparts, in addition to the publication of the IMF’s updated World Economic Outlook.

Andrew Foran, Economist | 416-350-8927

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of April 5th, 2024

Financial News Highlights

- Treasury yields shot higher this week, as expectations for a June rate cut fell in financial news.

- The U.S. economy had another strong month of hiring in March – adding 303k jobs – while the unemployment rate ticked down to 3.8%.

- Seven voting FOMC members were out speaking this week and the messaging was consistent: policymakers are in no rush to cut rates.

Don’t Bet on June

The first trading week of the second quarter saw Treasury yields push higher as market participants continued to dial back expectations on the timing of the first-rate cut. According to CME Fed futures, a June cut is only 53% priced, and expectations are now for a total of 60 basis points (bps) of cuts by year-end – a far cry from the 150-bps priced at the beginning of the year. Higher readings on inflation, a resilient economy, and a cautious FOMC have all been factors reinforcing the recent recalibration of expectations. At the time of writing, the 10-year Treasury yield is up 15 bps for the week (to 4.35%) and has risen nearly 50 bps since the beginning of the year.

The first trading week of the second quarter saw Treasury yields push higher as market participants continued to dial back expectations on the timing of the first-rate cut. According to CME Fed futures, a June cut is only 53% priced, and expectations are now for a total of 60 basis points (bps) of cuts by year-end – a far cry from the 150-bps priced at the beginning of the year. Higher readings on inflation, a resilient economy, and a cautious FOMC have all been factors reinforcing the recent recalibration of expectations. At the time of writing, the 10-year Treasury yield is up 15 bps for the week (to 4.35%) and has risen nearly 50 bps since the beginning of the year.

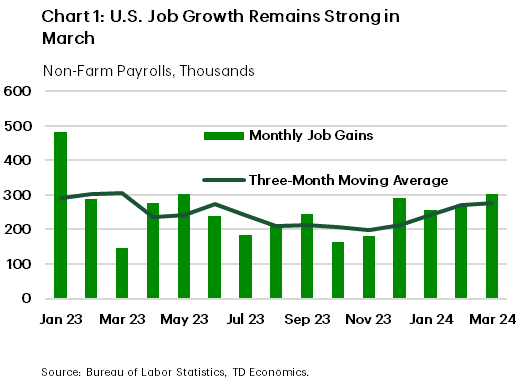

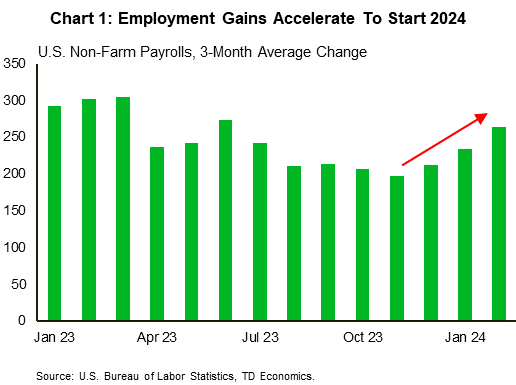

It was a very busy week on the economic data calendar, but the headline release was Friday’s employment report. The U.S. economy added 303k jobs in March, well ahead of the consensus forecast. Meanwhile, the household survey showed strong gains in both the labor force and civilian employment, with the net effect being the unemployment rate ticking down to 3.8%.

On aggregate, the labor market remains healthy and has yet to show any meaningful signs of cooling. Over the past three months, job gains have averaged 276k – slightly stronger than the 251k averaged in 2023 (Chart 1). With job openings still elevated, and increased immigration alleviating some of the pressure on labor supply, job growth could conceivably run in the 150k-200k range for the rest of the year. This would go a long way in rebalancing the labor market, without necessitating any meaningful increase in the unemployment rate.

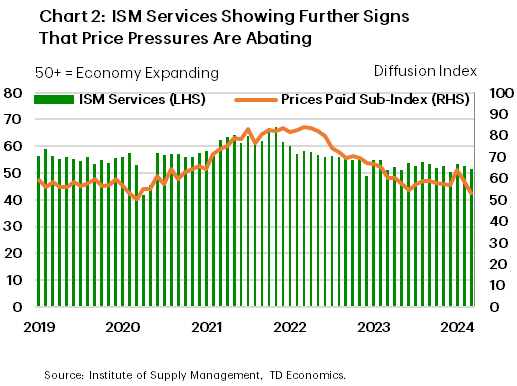

Other economic data out this week also brought encouraging news on the state of the economy. The ISM manufacturing index unexpectedly broke above the 50 mark – the threshold of expansion territory – for the first time in sixteen months in financial news. The release showed manufacturing activity is finding a firmer footing alongside an uptick in current production and a rebound in new orders. Meanwhile, the ISM services index slipped to a three-month low. The pullback reflected some softening in new-orders and a sharp decline in the prices paid sub-index, which fell to the lowest level since March 2020 (Chart 2). On the surface, this is an encouraging development for Fed officials who are struggling to rein in still elevated service inflation. However, the fact that 13 industries are still reporting an increase in prices suggests that even with some recent stabilization in the rate of price growth, elevated price pressures remain a concern.

Other economic data out this week also brought encouraging news on the state of the economy. The ISM manufacturing index unexpectedly broke above the 50 mark – the threshold of expansion territory – for the first time in sixteen months in financial news. The release showed manufacturing activity is finding a firmer footing alongside an uptick in current production and a rebound in new orders. Meanwhile, the ISM services index slipped to a three-month low. The pullback reflected some softening in new-orders and a sharp decline in the prices paid sub-index, which fell to the lowest level since March 2020 (Chart 2). On the surface, this is an encouraging development for Fed officials who are struggling to rein in still elevated service inflation. However, the fact that 13 industries are still reporting an increase in prices suggests that even with some recent stabilization in the rate of price growth, elevated price pressures remain a concern.

This is why all seven voting FOMC officials out speaking this week maintained a cautious tone on the timing of rate cuts. In a speech delivered on Wednesday, Chair Powell stuck to the script, reiterating that he still believes, ‘rate cuts are likely to be appropriate at some point this year’ though decisions will be made on a ‘meeting by meeting’ basis. With the Fed waiting for further evidence of cooling inflationary pressures, next week’s CPI release will offer further insight on whether the recent uptick in inflation a speed bump, or perhaps something more meaningful.

Thomas Feltmate, Director & Senior Economist | 416- 944-5730

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of March 22nd, 2024

Financial News Highlights

- Markets let out a sigh of relief as the Fed’s Summary of Economic Projections reaffirmed expectations for three rate cuts this year in major financial news.

- The Fed’s forecast for the economy is interesting, as it implies above trend growth in each of the next three years – despite interest rates that remain in restrictive territory.

- Forecasts for healthy growth and some renewal in the housing market set the stage for next week’s personal income and expenditures report.

Counting Cuts

Markets let out a sigh of relief as the Fed’s Summary of Economic Projections reaffirmed expectations for three rate cuts this year – rather than sending a more hawkish message by pulling back to two. In response, longer-term yields have extended their declines, with the 10-year Treasury down about 10 basis points (at the time of writing) since last Friday in financial news. Equities rallied on the news of easier policy, up just short of 1% after the projections were released.

Markets let out a sigh of relief as the Fed’s Summary of Economic Projections reaffirmed expectations for three rate cuts this year – rather than sending a more hawkish message by pulling back to two. In response, longer-term yields have extended their declines, with the 10-year Treasury down about 10 basis points (at the time of writing) since last Friday in financial news. Equities rallied on the news of easier policy, up just short of 1% after the projections were released.

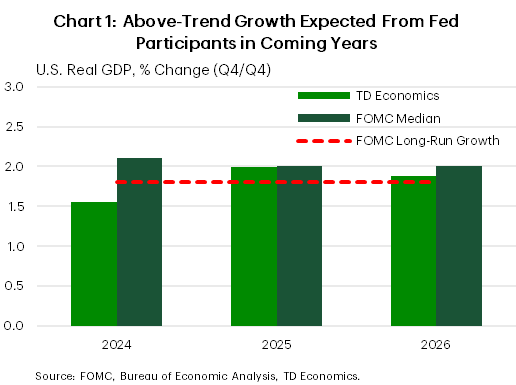

While avoiding sending an overtly hawkish signal, officials did upgrade both the economic outlook and expectations for the level of interest rates in 2025 and 2026. The forecast for the economy is interesting, as it implies above-trend growth in each of the next three years – despite interest rates that are in restrictive territory. Conversely, our forecast has the economy slowing in the latter half of 2024 as the cumulative effect of high rates and the drawdown of consumer savings begin to dent both job creation and spending (Chart 1).

Admittedly, the risks remain skewed to the upside for the economy, inflation and interest rates. The U.S. consumer has thus far shrugged off all expectations for a slowdown. Real expenditures grew at roughly three percent through the back half of 2023, and the labor market expanded by an average of 265k jobs (SAAR) in the three months through February. All of this has the first quarter of 2024 looking like it’s going to be another healthy period of expansion.

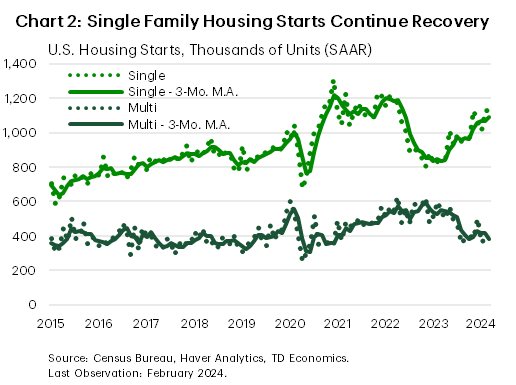

Even the housing sector, which has felt the brunt of a stagging rise in borrowing costs, has shown signs of life lately. Existing home sales and housing starts both left expectations in the rearview mirror. Moreover, the starts data reflect some rebalancing in the marketplace as single-family starts continue to grind higher adding units to a market starved for supply, while the multifamily segment slows down (Chart 2). Looking forward, increasing permitting activity suggests that there is some more room for improvement in housing construction.

Forecasts for healthy growth and some revival in the housing market set the stage for next week’s personal income and expenditures report. Markets will be on the lookout for signs that economic momentum carried through to February. Recall, January saw real spending contract, as weather weighed on economic activity, so a bounce-back is expected in February, with an accompanying uptick in headline inflation.

Forecasts for healthy growth and some revival in the housing market set the stage for next week’s personal income and expenditures report. Markets will be on the lookout for signs that economic momentum carried through to February. Recall, January saw real spending contract, as weather weighed on economic activity, so a bounce-back is expected in February, with an accompanying uptick in headline inflation.

For policymakers, the focus will be on the core personal consumption expenditures (PCE) price deflator. Last month core prices gained 0.4% on the month. Expectations are for a 0.3% monthly advance in February. Remember, monthly price growth of below 0.2% is what is consistent with the 2.0% inflation target, so an upside surprise to prices would suggest a still significant amount of excess demand in the economy – an outcome we should all be used to by now.

Andrew Hencic, Senior Economist | 416-944-5307

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of March 15th, 2024

Financial News Highlights

- February’s Consumer Price Index report showed that inflation came in higher-than-expected for a second consecutive month – a development which is likely to be on the Fed’s agenda at their two-day meeting next week in financial news.

- Spending in the retail sector disappointed expectations, despite some recovery from last month’s notable decline.

- With inflation top of mind, U.S. small businesses were also feeling less optimistic in February.

Sticky Prices Could Delay Rate Cuts

The key data among this week’s releases was the consumer price inflation numbers in financial news. While the headline monthly figure was in line with expectations, the details could give the Fed more to discuss in their upcoming policy meeting next week. Markets took the report in stride, with Treasury yields up a bit and the major stock indices closing the day higher after the release.

Delving into the details, the CPI report showed that both monthly and annual headline inflation accelerated in February, largely reflecting a rise in gasoline and shelter prices. This was also accompanied by higher-than-expected figures for both monthly and annual core inflation. Notably, the prices for core goods unexpectedly ticked higher in February after eight consecutive months of price declines. Back-to-back months of stronger than expected readings on core inflation point to an uneven road ahead as the Fed attempts to steer inflation back to target.

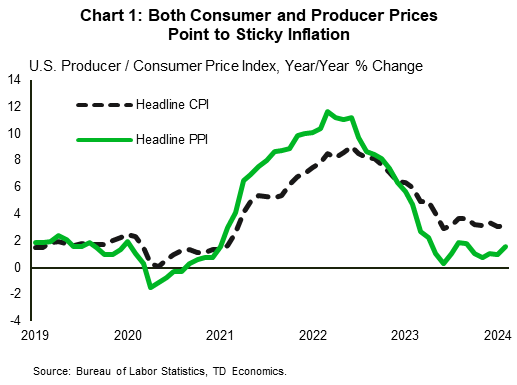

Price pressures further up the supply chain were also a little hotter than expected in February. The Producer Price Index (PPI) also came in above expectations. Both the monthly and annual headline PPI numbers accelerated relative to January. As such, both the consumer and producer price reports suggest that inflationary pressures remain sticky (Chart 1).

Adding to the subjects that the Fed will likely be mulling over during their meeting, is the 0.6% m/m gain in February’s retail sales after a sizeable pullback in January. On the upside, while retail sales growth flipped back to positive territory, it was lower than market expectations (0.8%). What’s more, the control group category, which factors into the calculation of personal consumption expenditure, was flat on the month relative to expectations for growth. Overall, the data suggests that consumers still have the ability to spend, despite challenges to their balance sheet, such as higher prices.

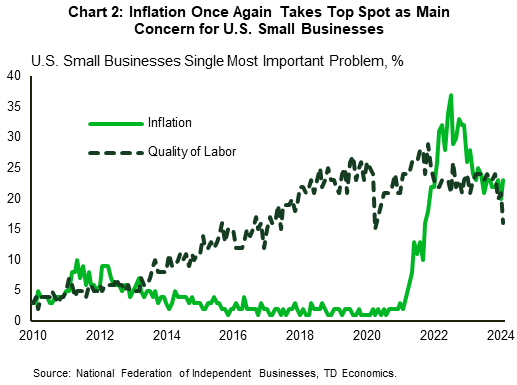

Inflation was also high on the list of concerns for America’s small businesses. A net 23% of respondents to the NFIB’s small business survey noted that inflation was their single most important business problem, up three points from the previous reading (Chart 2). Overall, small businesses were less optimistic in February, with the optimism index dropping to a nine-month low of 89.4. This was lower than market expectations for a slight improvement and notably below the series’ 50-year average of 98. On the upside, small businesses are having an easier time attracting and retaining employees, such that the net percentage of firms who increased compensation or are planning to do so in the near-term both fell over the month.

The key takeaway from this week’s releases is that while the labor market is normalizing as indicated by responses from the small business sector, consumers still have spending power and inflationary pressures have not fully abated. The combination suggests that the Fed is likely to remain cautious with respect to rate cuts, erring on the side of leaving rates higher for longer rather than take the risk of re-igniting price pressures by cutting prematurely.

Shernette McLeod, Economist | 416-415-0413

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of March 8th, 2024

Financial News Highlights

- The U.S. economy added 275k jobs in February, but job gains in the prior two months were revised down significantly and the unemployment rate ticked up to 3.9% in financial news.

- In his testimony before Congress this week, Federal Reserve Chair Powell noted that economic resilience gave the FOMC time to assess the sustainability of current disinflation trends.

- Congress is set to pass half of the federal spending bills for the 2024 fiscal year this week, five months and four continuing resolutions after the fiscal year began in October.

A Busy Week in Washington

With the first quarter entering its final weeks, we received a host of important economic data this week that will help form expectations for the year ahead in financial news. This included a labor market pulse check in addition to Federal Reserve Chair Powell’s semi-annual testimony before Congress. Equity markets continued to notch record highs, with the S&P 500 rising 0.8% on the week, while Treasury yields fell by roughly 10 basis-points as of the time of writing.

With the first quarter entering its final weeks, we received a host of important economic data this week that will help form expectations for the year ahead in financial news. This included a labor market pulse check in addition to Federal Reserve Chair Powell’s semi-annual testimony before Congress. Equity markets continued to notch record highs, with the S&P 500 rising 0.8% on the week, while Treasury yields fell by roughly 10 basis-points as of the time of writing.

The headline release for this week was Friday’s employment report, which showed that 275k jobs had been added in February. While job gains in the prior two months were revised down by a considerable 167k jobs, the economy still saw solid and accelerating job growth moving into 2024 (Chart 1). However, the unemployment rate ticked up by 0.2 percentage-points to 3.9%, in part due to a return of positive labor force growth. On aggregate, the labor market remains healthy but is continuing to moderate towards a more balanced state. This will be welcome news for the Federal Reserve as they target their dual mandate of maximum sustainable employment and price stability.

The shift towards a more balanced risk outlook was also noted in Chair Powell’s testimony to Congressional committees this week. In his remarks he stated that the resilience of the economy and the labor market gave the FOMC time to assess the sustainability of current disinflation trends. While Powell did note that it would likely be necessary to implement less restrictive policy this year, he cautioned against the risk of easing pre-maturely. Solid job growth and an economy that continues to exhibit above-trend growth support Chair Powell’s assessment and our expectation that the FOMC will hold off until July to begin lowering interest rates.

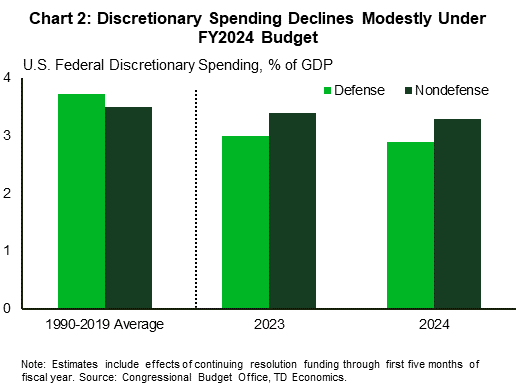

Also on Capitol Hill this week, Congress passed half of the federal spending bills for fiscal year 2024. With funding for six federal departments set to expire on Friday – legislated by the fourth continuing resolution of this cycle passed last week – the House passed a package of appropriation bills on Wednesday for the departments subject to the deadline. Senate approval and the President’s signature is expected ahead of the midnight deadline on Friday. The other six appropriations bills will need to be passed ahead of their March 22nd deadline, but aggregate spending levels are expected to be consistent with the limits previously agreed to by Congress (Chart 2). Removing the near-term risk of a government shutdown is undoubtedly positive, but ongoing structural deficits leave the sustainability of the national debt a long-term risk, which was also noted by Chair Powell in Congress this week.

Also on Capitol Hill this week, Congress passed half of the federal spending bills for fiscal year 2024. With funding for six federal departments set to expire on Friday – legislated by the fourth continuing resolution of this cycle passed last week – the House passed a package of appropriation bills on Wednesday for the departments subject to the deadline. Senate approval and the President’s signature is expected ahead of the midnight deadline on Friday. The other six appropriations bills will need to be passed ahead of their March 22nd deadline, but aggregate spending levels are expected to be consistent with the limits previously agreed to by Congress (Chart 2). Removing the near-term risk of a government shutdown is undoubtedly positive, but ongoing structural deficits leave the sustainability of the national debt a long-term risk, which was also noted by Chair Powell in Congress this week.

In the near-term, markets will be closely watching the February CPI inflation data release next week, which is expected to show a deceleration from January’s unexpected uptick. Further progress on disinflation will be required before the Federal Reserve considers shifting its current policy stance.

Andrew Foran, Economist | 416-350-8927

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of March 1st, 2024

Financial News Highlights

- January’s personal and income spending report landed just where it was expected to, with the only surprise coming from a bigger than expected lift from nominal personal income growth in financial news.

- The Fed’s preferred measure of inflation, core personal consumption expenditure prices, cooled to 2.8% year-on-year, with near-term trends suggesting it has room to fall.

- A weaker-than-expected ISM manufacturing report helped support the notion that demand is cooling.

Coming Off the Boil?

January’s personal and income spending report landed just where it was expected to, with the only surprise coming from a bigger lift from nominal personal income growth in financial news. The as-expected print comes on the heels of updated GDP data that showed consumer spending closed out last year at an even better pace than originally thought. Most importantly, an upside inflation surprise was averted in January, allowing markets to let out a sigh of relief. After the data release Treasury yields tumbled and equities rallied. The data showed that price pressures continue to cool off. However, for a cautious Fed more progress will have to be made, leaving the first policy rate cuts a ways away.

January’s personal and income spending report landed just where it was expected to, with the only surprise coming from a bigger lift from nominal personal income growth in financial news. The as-expected print comes on the heels of updated GDP data that showed consumer spending closed out last year at an even better pace than originally thought. Most importantly, an upside inflation surprise was averted in January, allowing markets to let out a sigh of relief. After the data release Treasury yields tumbled and equities rallied. The data showed that price pressures continue to cool off. However, for a cautious Fed more progress will have to be made, leaving the first policy rate cuts a ways away.

First and foremost, this week’s personal income and spending report showed real personal consumption expenditures (PCE) pulled back 0.1% in January after healthy gains in November and December. Not a big surprise after January’s retail sales report showed a significant pullback. With some weather related factors weighing on demand it’s likely that this was more of a one-off than a new trend and February will likely show some bounce back.

Stronger-than- expected growth in personal income was largely a result of a larger cost of living adjustment in social security payments (and other government transfers), and the inflation adjusted real personal disposable income (PDI) measure showed no growth. Looking forward, this is what we’re interested in, as the downbeat month shaved two percentage points off of annual real PDI growth, bringing it down to 2.1% year-on-year. A deceleration in total real income growth is going to be part of the formula that cools the relentless consumer demand we’ve seen from the U.S. since the pandemic.

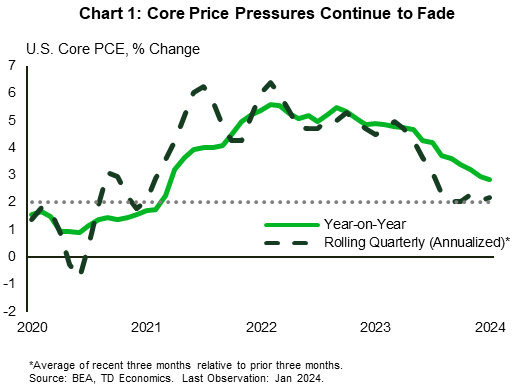

Of course, the Fed isn’t after just slowing the economy, but bringing demand and supply into better balance to tame inflation. On this front, yesterday’s report brought welcome news. The Fed’s preferred measure of inflation (core PCE) cooled to 2.8% year-on-year. Yes, still above the Fed’s target, but this is owing to base-effects from last year. Take a closer look at any near-term metrics and inflation is looking a lot closer to target. The three-month and six-month rates are at 2.6% and 2.5% (annualized), respectively. Smooth out some of the month-to-month noise in the series by taking a rolling quarterly rate of change, and core PCE prices have been advancing between 2% and 2.3% (annualized) since last September (Chart 1).

Of course, the Fed isn’t after just slowing the economy, but bringing demand and supply into better balance to tame inflation. On this front, yesterday’s report brought welcome news. The Fed’s preferred measure of inflation (core PCE) cooled to 2.8% year-on-year. Yes, still above the Fed’s target, but this is owing to base-effects from last year. Take a closer look at any near-term metrics and inflation is looking a lot closer to target. The three-month and six-month rates are at 2.6% and 2.5% (annualized), respectively. Smooth out some of the month-to-month noise in the series by taking a rolling quarterly rate of change, and core PCE prices have been advancing between 2% and 2.3% (annualized) since last September (Chart 1).

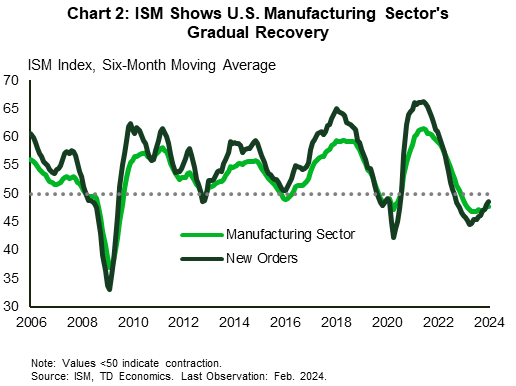

February’s ISM manufacturing report closed out the week, and supported the notion that demand is coming off a boil. With a 47.8 print for the month, the reading fell well short of market expectations and signaled that the recovery in the manufacturing sector is progressing rather slowly (Chart 2). Moreover, new manufacturing orders show that demand remains tepid.

For the Fed, these indicators come as signs that the relentless demand that powered the U.S. economy in late-2023 might be cooling off. Next Tuesday’s February ISM services report should shed light on the much larger services sector, while Fed Chair Jerome Powell’s testimony on Wednesday will hopefully give us a better sense of how the Fed is viewing these latest numbers.

Andrew Hencic, Senior Economist | 416-944-5307

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.

Financial News for the Week of February 23rd, 2024

Financial News Highlights

- U.S. inflation rose more than anticipated to start the year, on a Consumer Price Index basis, largely due to greater price pressures within the services sector in financial news.

- However, retail spending surprised to the downside in January, suggesting that consumer spending may be less vigorous than the stunning pace of last year.

- A slowdown in housing starts and less optimistic small businesses also suggest that economic momentum may be cooling.

Slow Your Roll

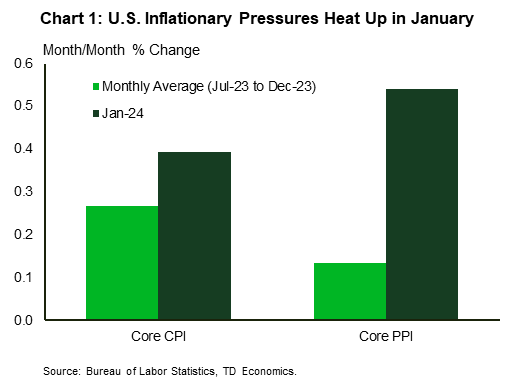

Slow your roll. That was the messaging communicated in the Federal Reserve’s meeting minutes released earlier this week. In hindsight, Fed officials had every reason to remain cautious in timing the pivot to policy easing. Since the January 30th-31st FOMC meeting, the economic data has done little to instill further confidence that inflationary pressures will continue to recede over the coming months. Not only did the January employment report come in more than double expectations, but a few inflation indicators (including CPI, PPI, and ISM price sub-indices) all came in much hotter-than-expected in January (Chart 1).

Slow your roll. That was the messaging communicated in the Federal Reserve’s meeting minutes released earlier this week. In hindsight, Fed officials had every reason to remain cautious in timing the pivot to policy easing. Since the January 30th-31st FOMC meeting, the economic data has done little to instill further confidence that inflationary pressures will continue to recede over the coming months. Not only did the January employment report come in more than double expectations, but a few inflation indicators (including CPI, PPI, and ISM price sub-indices) all came in much hotter-than-expected in January (Chart 1).

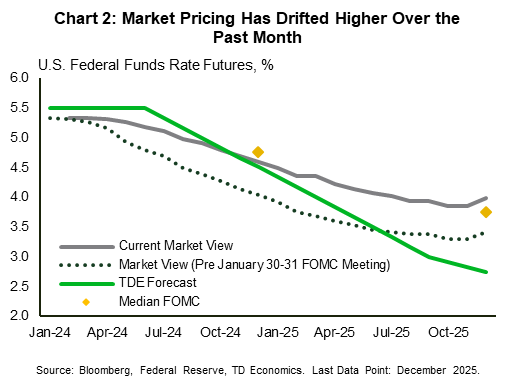

Market pricing has adjusted accordingly in recent weeks, with investors now positioned for a June rate cut and 100 basis points (bps) of policy easing by year-end – a trajectory that more closely aligns to both the FOMC’s and our own forecast (Chart 2).

While Fed officials acknowledged that inflation and employment risks are coming back into better balance, the minutes revealed that most participants remain concerned about the risk of “moving too quickly to ease the stance of policy”. Moreover, some officials cited the risk that stronger aggregate demand or a slow-down in the supply-side recovery could impede further progress on the inflation front. All of this argues for a more agile, data dependent approach to reducing the policy rate.

This is especially true given the recent growth dynamics. Economic growth remained incredibly resilient through the second half of last year – averaging an impressive 4% (annualized) or more than double its long-run potential. While first-quarter momentum looks to have lost a step, it’s still tracking a relatively robust 2-2.5%. As highlighted in our Quarterly Q&A publication released earlier this week, our current forecast assumes economic momentum will continue to soften as the year progresses. However, this is largely predicated on a further cooling in the labor market, resulting in slower income growth and weaker consumer spending. Should the labor market prove more resilient, then there’s an obvious upside risk to both spending and near-term inflation dynamics.

Next week we’ll get a pulse check on consumer spending and income trends for January. Accompanying the release will be the core PCE inflation data, which is likely to show an increase of 0.4% month-on-month – the strongest monthly gain in a year. It remains to be seen if January’s acceleration is a one-off, perhaps influenced by businesses increasing prices at the start of the year in a way that may not be fully captured by seasonal adjustment factors, or whether it’s the beginning of something more insidious. Either way, the recent uptick in inflationary pressures serves as a reminder that the descent back to 2% will likely come with some turbulence.

Next week we’ll get a pulse check on consumer spending and income trends for January. Accompanying the release will be the core PCE inflation data, which is likely to show an increase of 0.4% month-on-month – the strongest monthly gain in a year. It remains to be seen if January’s acceleration is a one-off, perhaps influenced by businesses increasing prices at the start of the year in a way that may not be fully captured by seasonal adjustment factors, or whether it’s the beginning of something more insidious. Either way, the recent uptick in inflationary pressures serves as a reminder that the descent back to 2% will likely come with some turbulence.

This is exactly why Fed Governors have been preaching patience over the past few weeks. Perhaps no one said it better than Christopher Waller, who noted “the strength of economy and the recent data on inflation mean it is appropriate to be patient, careful, methodical, deliberate – pick your favorite synonym”. “Whatever word you pick, they all translate to one idea: What’s the rush?”.

Thomas Feltmate, Director & Senior Economist | 416- 944-5730

This Financial News report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this financial news report has been drawn from sources believed to be reliable but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. Do you have any questions about your finances? As financial advisors in Cornelius NC, Naples FL, and Moultonborough NH we are happy to help.

To see more news reports, click here.